Published September 16, 2025

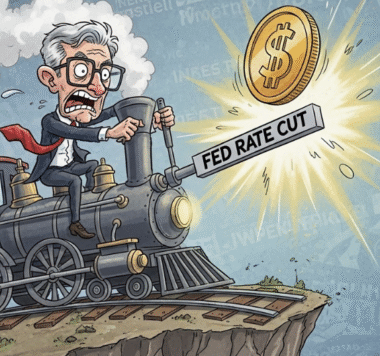

Picture this: A bunch of very serious economists in expensive suits are about to gather in a room and make decisions that could affect everything from your mortgage payment to whether that startup you’ve been eyeing can actually get funding. Welcome to Federal Reserve meeting season, folks.

What’s Actually Happening?

Starting today, the Federal Reserve kicks off its two-day monetary policy powwow. Think of it as the economic equivalent of a Marvel movie – lots of buildup, everyone has opinions, and the ending will definitely impact the sequel (aka your financial future).

The big question everyone’s asking: Will they cut interest rates?

Most Wall Street crystal ball gazers are betting yes, which would be the Fed’s first rate cut since December. But here’s where it gets spicy – the Fed committee appears more divided than a family deciding on a Netflix show.

Why You Should Actually Care

Lower interest rates aren’t just numbers on a screen. They’re the difference between your mortgage rate being “ouch” versus “manageable,” your credit card debt feeling like quicksand versus just regular sand, small businesses being able to expand or just survive, and your job market staying robust or getting a bit wobbly.

But here’s the catch (there’s always a catch): Cut rates too aggressively, and inflation might come roaring back like that friend who “just needs to crash on your couch for a week.”

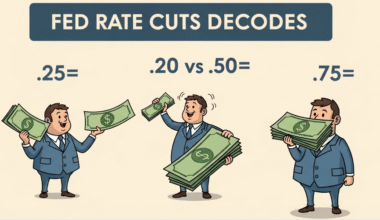

The Great Rate Cut Debate: 25 or 50?

The August jobs report was about as exciting as watching paint dry in slow motion, which has markets expecting a rate cut. But how big?

The Fed has two main options here. They could go conservative with a 0.25% cut that would lower the benchmark rate to 4% to 4.25%. This follows their usual playbook and is boring but probably smart. Or they could surprise everyone with an aggressive 0.5% cut that drops rates to 3.75% to 4%. This would shock markets and possibly some Fed members, but currently has about the same odds as finding a parking spot in Manhattan.

Most economists are betting on the smaller cut, calling it “all but a given.” Translation: It’s happening unless aliens land on the White House lawn.

Plot Twist: The Wild Card Players

Here’s where things get interesting. The Senate just confirmed Trump’s newest Fed appointee, Stephen Miran, literally yesterday. Guy’s probably still figuring out where the coffee machine is, and now he gets to help decide the economic fate of 330 million Americans. Talk about jumping into the deep end.

Meanwhile, there’s ongoing drama with Fed Governor Lisa Cook, whom Trump tried to fire but got blocked by federal courts. It’s like a political soap opera, but with more PowerPoint presentations.

The Dissent Watch

Buckle up, because this meeting could see more disagreement than a group chat about dinner plans. Two Trump appointees – Christopher Waller and Michelle Bowman – have been pushing for bigger rate cuts and might dissent again.

If three governors dissent, it would be the most divided Fed meeting since 1988. That’s back when people still used fax machines and thought the internet was just a fad.

What the “Dots” Will Tell Us

The Fed releases something called a “dot plot” (yes, really) showing where officials think rates should go. Think of it as their economic crystal ball, except it’s made by committee and changes every few months.

The dots will reveal whether the Fed plans more cuts in October and December, plus their 2026 outlook. Markets are currently expecting about 150 basis points in cuts through next year – that’s Wall Street speak for “a lot.”

But don’t hold your breath for the Fed to validate those expectations. They’re more likely to keep their cards close to their vest than a poker player with a royal flush.

The Bottom Line for You

This meeting matters because the Fed’s decisions ripple through everything. For homebuyers, mortgage rates could get friendlier. For savers, your savings account might earn even less (sorry). For investors, stock markets will probably do something dramatic. And for borrowers, credit could get cheaper across the board.

Fed Chair Jerome Powell will face the press at 2:30 PM ET on Wednesday, where he’ll try to explain whatever complex economic chess game the committee just played. Analysts are already calling it a potentially “challenging press conference” – economist speak for “this could get awkward.”

The Real Value Here

While everyone else is obsessing over the exact number of basis points, the smart money is watching the bigger picture: How will the Fed balance supporting the job market without letting inflation get out of control, especially with potential tariffs on the horizon?

Your move? Keep an eye on how this affects your personal finances, but don’t panic-buy anything or make major financial decisions based on one Fed meeting. The economy is like a massive cargo ship – it doesn’t turn on a dime, even when very important people in suits really want it to.

Stay tuned for Wednesday’s decision. It’ll be more entertaining than most reality TV, and definitely more consequential for your bank account.