Stock Symbol: MSFT | Current Price: ~$415 (September 2025) | Target Price: $520+ | Timeframe: 12-18 months

NOT FINANCIAL ADVISE

Remember when Microsoft was that company everyone made fun of for Internet Explorer and Clippy? Plot twist: they’re now the AI kingmaker that turned everyone’s boring office suite into a productivity superpower. With Q2 2025 revenue hitting $69.6 billion (up 12% year-over-year) and AI services growing 157% annually, Microsoft has successfully transformed from “have you tried turning it off and on again?” to “let AI do that for you.” Nearly 70% of Fortune 500 companies use Microsoft 365 Copilot, Azure surpassed $75 billion in annual revenue, and somehow Satya Nadella convinced the world that paying $30 extra per month for an AI assistant to write emails is not just reasonable but essential. It’s like watching your reliable but boring friend suddenly become the coolest person at the party.

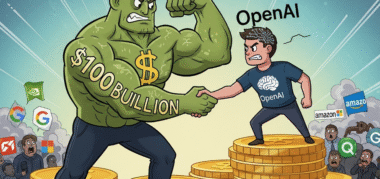

The $13 Billion OpenAI Friendship That Pays Off

Microsoft’s $13 billion investment in OpenAI represents either the smartest partnership in tech history or the world’s most expensive friendship, and honestly, both can be true. The OpenAI partnership remains in place through 2030, with Microsoft maintaining access to OpenAI’s intellectual property, which is basically like having exclusive rights to the smart kid’s homework for the next five years.

The strategic partnership has evolved beyond simple investment into deep integration across Microsoft’s entire product stack. Azure OpenAI services power everything from Copilot to custom enterprise applications, creating a comprehensive AI platform that competitors are struggling to match. It’s like Microsoft bought the future and then figured out how to rent it to everyone else at premium prices.

Microsoft’s recent introduction of MAI-1-preview, their proprietary AI model, shows they’re not putting all their eggs in the OpenAI basket. Testing their own AI model while maintaining the OpenAI partnership is the business equivalent of dating someone while keeping your options open, except in this case, both relationships seem to be working out beautifully.

Copilot: The AI Assistant Everyone Actually Uses

Microsoft 365 Copilot adoption is accelerating faster than any other new Microsoft 365 suite, with nearly 70% of Fortune 500 companies now using it. This isn’t just corporate window dressing – businesses are reporting up to 353% ROI from Copilot implementation, which means companies are making $3.53 for every dollar they spend on AI-powered procrastination tools.

The beauty of Copilot is that it turned everyone into a productivity expert without requiring actual productivity expertise. Need to write a professional email? Copilot’s got it. Want to analyze a spreadsheet without crying? Copilot to the rescue. It’s like having an incredibly competent intern who never needs coffee breaks and doesn’t judge your questionable formatting choices.

Microsoft 365 Commercial cloud revenue increased 15% partly driven by premium E5 subscriptions and Copilot features, proving that when you make people’s work lives easier, they’re surprisingly willing to pay for the privilege. Copilot usage reportedly tripled year-over-year, which suggests people either love AI assistance or really hate doing their own work.

Azure: The Cloud That Conquered the World

Azure surpassed $75 billion in annual revenue, up 34%, making it one of the fastest-growing large-scale businesses in technology history. Azure and other cloud services revenue grew 33% in constant currency, with healthy consumption trends that suggest enterprises are not just trying Azure but actually using it for important things.

The AI boom is transforming Azure from generic cloud infrastructure into specialized AI computing platform. The number of Azure OpenAI apps running on Azure databases and app services more than doubled year-over-year, creating a virtuous cycle where AI applications drive demand for supporting services. It’s like selling someone a car and then discovering they also need gas, insurance, and a place to park it.

Azure’s integration with OpenAI services creates competitive advantages that are extremely difficult for competitors to replicate. When your cloud platform comes with exclusive access to the world’s most advanced AI models, selling cloud services becomes less about price competition and more about AI capabilities, which is a much more profitable conversation to have with customers.

The Enterprise AI Revolution (With PowerPoint)

Microsoft’s enterprise AI strategy extends far beyond flashy chatbots into practical business applications that actually matter. Microsoft Fabric, their data analytics platform, continues gaining momentum with revenue up 55% year-over-year and over 25,000 customers, making it the fastest-growing database product in company history.

The integration of AI across Microsoft’s productivity suite creates network effects that increase customer stickiness while justifying premium pricing. When Copilot helps write documents in Word, analyze data in Excel, create presentations in PowerPoint, and manage meetings in Teams, switching to competitive products becomes exponentially more difficult and expensive.

Microsoft’s approach to AI emphasizes practical business value over technological showing off. Instead of building AI for the sake of AI, they’ve focused on solving actual workplace problems like “how do I make this spreadsheet less terrible?” and “can someone else write this email for me?” It turns out these are billion-dollar problems when you solve them at enterprise scale.

Investment Reality Check: What Could Go Wrong

Microsoft’s biggest risk might be the complexity of managing multiple AI relationships while building proprietary capabilities. The OpenAI partnership, while profitable, creates dependence on external technology for core competitive advantages. Developing MAI-1 and other proprietary models reduces this risk but requires significant additional investment.

Competition in cloud services remains intense, with Amazon and Google making substantial investments in AI capabilities. Azure’s 33% growth rate, while impressive, requires continued innovation and competitive pricing to maintain market share against well-funded rivals who also have their own AI strategies.

Regulatory scrutiny of Microsoft’s market power continues to intensify, particularly as AI integration strengthens the company’s competitive position across multiple markets. The combination of dominant productivity software, growing cloud market share, and exclusive AI partnerships creates antitrust concerns that could limit future strategic options.

Financial Outlook: The Numbers Don’t Lie

Q2 2025 revenue reached $69.6 billion with 12% year-over-year growth, demonstrating Microsoft’s ability to maintain growth momentum at unprecedented scale. AI services growing 157% annually indicates that the AI transformation is translating into measurable financial results rather than just marketing promises.

Microsoft Cloud gross margin percentage of roughly 70% provides substantial profitability even while investing heavily in AI infrastructure. The company’s ability to maintain high margins while scaling AI capabilities suggests effective cost management and strong customer demand for AI-enhanced services.

Capital expenditures continue increasing to support cloud and AI demand, but the investments are generating measurable returns through higher revenue growth and improved customer retention. It’s like spending money on a gym membership and actually getting in better shape, except the gym is artificial intelligence and the better shape is exponential business growth.

Price Target: Betting on the AI Office

Based on Microsoft’s comprehensive AI integration, Azure dominance, and enterprise market penetration, the company presents a compelling investment opportunity with a 12-18 month price target of $520+ per share. This reflects both fundamental growth driven by AI adoption and multiple expansion as investors recognize the sustainability of Microsoft’s competitive advantages.

Key catalysts include continued Copilot adoption acceleration, Azure growth maintenance above 30%, successful monetization of proprietary AI models, and expansion of AI capabilities across the entire product portfolio. Microsoft has successfully evolved from productivity software company to AI platform provider, creating multiple revenue streams that compound rather than compete.

For investors seeking exposure to the AI revolution through a company with proven execution capability, diversified revenue streams, and comprehensive market coverage, Microsoft represents the ultimate “AI for grown-ups” investment. They’ve taken the complexity out of enterprise AI adoption while taking the profits out of enterprise AI spending, which is exactly what you want from a technology investment.

Disclaimer: This analysis contains references to Clippy and should not be considered personalized investment advice. Past performance does not guarantee future results, though Microsoft’s track record suggests they’ve figured out how to make boring enterprise software surprisingly profitable. Consult with a qualified financial advisor who hopefully understands both AI and PowerPoint.

Last Updated: September 2025

Next Review: December 2025