Some said growth stocks are a hedge against inflation. They’re NOT! Now that we’ve gotten that myth out of the way, let’s talk about what’s actually happening in traditional markets and why everything is falling apart.

Markets are capitulating. Hard. But here’s what makes this different – while traditional markets have more regulatory oversight than crypto, the big institutional players still have massive advantages. High-frequency trading algorithms, dark pools, and sophisticated options strategies give them tools that retail investors can only dream of.

The game is still heavily tilted, plain and simple. Those massive hedge funds and institutional traders are targeting retail portfolios, knowing exactly how to trigger stop-losses and margin calls. And you know what they’re thinking? “These individual investors came here chasing meme stocks and quick gains, but they’re just going to lose it all anyway when reality hits.”

It’s brutal, but that’s the world we’re trading in.

So what’s the survival strategy here? AVOID LEVERAGED PRODUCTS AT ALL COSTS. I cannot stress this enough. Leveraged ETFs are getting absolutely destroyed. Options traders are getting rekt on both calls and puts. The volatility is so extreme that both bulls and bears are getting played.

If you’ve got the conviction, stick to actual stock ownership – no margin, no leverage. At least then you won’t get forced out when these institutions decide to shake the tree.

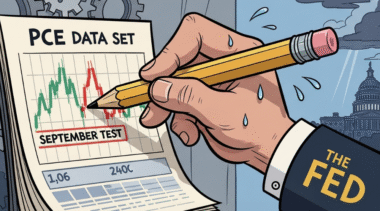

But here’s where it gets really ugly. PCE data drops Friday, and everyone’s holding their breath. June core PCE was 2.8%, then it jumped to 2.9% in July. August numbers? They’re expected to stay flat or – God help us – tick even higher.

This isn’t just some minor economic hiccup. August CPI is looking like it’ll come in hotter than July, which means the inflation monster is still very much alive and grinning at our collective misery.

And here’s the gut punch: there will be NO rate cuts in October FOMC. None. Zero. The Fed isn’t coming to save overleveraged portfolios this time.

Value Propositions in This Mess:

- Dividend aristocrats with 25+ years of consecutive increases – they’ve survived worse storms

- Utilities and consumer staples – people still need electricity and groceries when markets crash

- Energy infrastructure – pipeline companies and refineries with actual cash flow

- REIT liquidations – when overleveraged real estate gets dumped, cash buyers clean up

I hate to be the bearer of bad news, but a broader market correction isn’t just possible – it’s inevitable at this point. The writing is on the wall, folks.

Buckle up for safety, because traditional markets are about to get a whole lot more volatile.