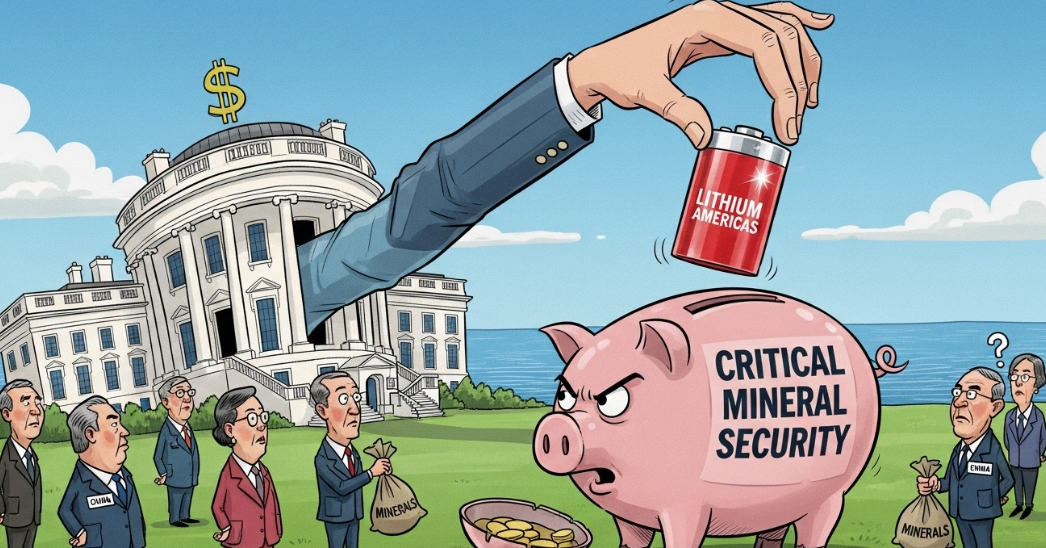

The 100% stock surge tells only half the story of America’s bold move to secure its lithium future

Lithium Americas (NYSE: LAC)

The financial markets witnessed something extraordinary on Wednesday: Lithium Americas (NYSE: LAC) shares rocketed nearly 100% following reports that the White House is seeking an unprecedented equity stake in the Canadian mining company. But beneath the headline-grabbing stock movement lies a far more significant transformation – the emergence of a new paradigm where national security and critical mineral supply chains converge in ways that would have been unimaginable just a few years ago.

The Strategic Pivot: From Loan to Ownership

What began as a straightforward $2.2 billion Department of Energy loan for Lithium Americas’ Nevada Thacker Pass project has evolved into something far more strategic. The Trump administration’s proposal to take an equity stake represents a fundamental shift in how America approaches critical mineral security – moving from passive financial support to active ownership and control.

This isn’t merely about mining lithium; it’s about reshaping the entire architecture of America’s energy independence. The White House’s unprecedented offer to a Canadian corporation signals a recognition that traditional market mechanisms alone cannot secure the supply chains that will power America’s electric future.

The Thacker Pass Imperative: Building North America’s Lithium Crown Jewel

Nestled in northern Nevada, the Thacker Pass project represents far more than another mining venture. When operations begin in late 2027, this site is positioned to become one of North America’s largest lithium sources – a designation that carries enormous strategic weight in an era where lithium has become the “white gold” of the clean energy transition.

The partnership with General Motors adds another layer of strategic importance. This isn’t just about extracting minerals from the ground; it’s about creating an integrated supply chain that connects American lithium production directly to American electric vehicle manufacturing. The implications extend far beyond the immediate parties involved, potentially serving as a template for future domestic supply chain initiatives.

The Pattern Recognition: Following the MP Materials Playbook

The White House’s approach to Lithium Americas follows a proven playbook. In July, the Department of Defense secured a 15% ownership stake in MP Materials, a rare earth mining company. Since that acquisition, MP Materials’ stock has more than doubled, demonstrating both the market’s appetite for government-backed critical mineral plays and the strategic value such partnerships create.

This pattern reveals a broader strategic doctrine emerging from Washington: direct equity participation in companies that control critical supply chains. It’s a departure from traditional American capitalism, but one that reflects the new realities of great power competition in the 21st century.

The China Factor: Countering State-Sponsored Competition

Interior Secretary Doug Burgum’s April revelation about the administration’s willingness to purchase equity stakes in mining companies wasn’t made in a vacuum. It was a direct response to what he characterized as “Chinese state-sponsored competition” – a recognition that America’s private sector adversaries aren’t operating under the same market constraints as American companies.

China’s dominance in critical mineral processing and supply chains didn’t happen by accident. It resulted from decades of strategic state investment and coordination between government and industry. The White House’s move on Lithium Americas represents America’s attempt to level the playing field using similar tools of statecraft.

The Negotiation Dynamics: When Strategic Assets Meet Financial Reality

The current renegotiation of loan terms reveals the complex dance between financial pragmatism and strategic necessity. Lithium Americas and General Motors reportedly failed to meet initial payout requirements, necessitating a restructuring that would defer some loan payments to later years. Rather than viewing this as a setback, the Trump administration saw an opportunity to deepen its involvement.

This dynamic illustrates a crucial principle in the new era of strategic resource management: financial challenges can become pathways to strategic control. When critical supply chains are at stake, traditional lending relationships can evolve into equity partnerships that serve broader national interests.

The Regulatory Complexity: Canadian Sovereignty Meets American Strategy

The potential requirement for Canadian regulatory approval adds a fascinating dimension to this transaction. It represents the first time the US government has proposed such a direct equity investment in a Canadian corporation, creating precedent that could reshape cross-border investment in critical industries.

This regulatory complexity isn’t merely administrative – it reflects the broader challenge of securing critical supply chains in an interconnected world where strategic assets often cross national boundaries. The success of this arrangement could establish new frameworks for international cooperation on critical mineral security.

The Market Signal: Wall Street Embraces the New Paradigm

The 100% stock surge following the equity stake reports sends a clear message: markets are embracing this new model of government-private sector partnership in critical industries. Investors aren’t just betting on lithium prices or mining efficiency – they’re betting on the strategic value that government partnership brings to these ventures.

This market response suggests a broader recognition that traditional purely private-sector approaches to critical mineral development may be insufficient in the current geopolitical environment. Government partnership isn’t being viewed as market interference, but as strategic enhancement.

The Broader Transformation: From Private Mining to Strategic Infrastructure

What’s happening with Lithium Americas reflects a fundamental transformation in how America views critical mineral assets. These aren’t simply private mining ventures competing in global commodity markets – they’re strategic infrastructure as vital to national security as ports, airports, or telecommunications networks.

This shift in perspective justifies government equity participation and creates new frameworks for public-private partnership. When lithium mining is viewed through the lens of national security rather than pure market dynamics, direct government investment becomes not just acceptable but necessary.

The Future Framework: Templates for Strategic Resource Control

The Lithium Americas arrangement, combined with the earlier MP Materials investment, is establishing new templates for American engagement with critical resource companies. These precedents suggest future scenarios where government equity participation becomes standard practice for companies controlling strategic supply chains.

This emerging framework could extend beyond minerals to other critical industries – semiconductors, rare earth processing, battery manufacturing, and other sectors where supply chain security intersects with national security. The implications extend far beyond any single company or commodity.

The Investment Thesis: Why This Changes Everything for LAC

For investors in Lithium Americas, the government equity stake represents more than financial backing – it provides strategic insurance against the various risks that plague mining ventures. Government partnership offers protection against regulatory challenges, supply chain disruptions, and competitive pressures from state-sponsored rivals.

Moreover, the association with US strategic priorities likely enhances the company’s access to additional government support, preferential treatment in permitting processes, and priority status in future critical mineral initiatives. This isn’t just about capital; it’s about operating within America’s strategic resource ecosystem.

The Long Game: Building America’s Lithium Independence

The Thacker Pass project, with government equity participation, represents a crucial building block in America’s quest for lithium independence. When combined with other domestic initiatives and strategic partnerships, it contributes to a broader vision of supply chain sovereignty that reduces dependence on potentially adversarial nations.

This long-term perspective helps explain why the government is willing to take equity stakes rather than merely provide loans. Ownership provides control, and control provides security – essential elements when dealing with resources critical to America’s energy and economic future.

Conclusion: A New Chapter in Resource Nationalism

The Lithium Americas equity stake proposal represents more than a single transaction – it signals the emergence of a new era in American resource policy. The 100% stock surge reflects market recognition that this isn’t just about mining lithium; it’s about securing America’s position in the global competition for critical minerals.

As the clean energy transition accelerates and geopolitical tensions intensify, the model pioneered with companies like MP Materials and now proposed for Lithium Americas may become the standard approach for securing strategic supply chains. The fusion of government strategic interests with private sector efficiency creates a new paradigm that could reshape entire industries.

For Lithium Americas, the journey from a Canadian mining venture to a strategic American asset illustrates the profound changes reshaping the global economy. In an era where critical minerals have become instruments of statecraft, the company finds itself at the center of America’s bid for resource independence – a position that promises both unprecedented opportunities and unique responsibilities.

The ultimate success of this arrangement will be measured not just in stock prices or production volumes, but in its contribution to America’s long-term strategic autonomy. In that context, the 100% stock surge may prove to be just the beginning of a much larger transformation.